Falling dollars and falling US exports: Q2 2009

by John Schroy filed under Leadership

According to the Federal Reserve flow of funds accounts (Release Z.1), the long-term rise in US exports was reversed decisively in the first half of 2009.

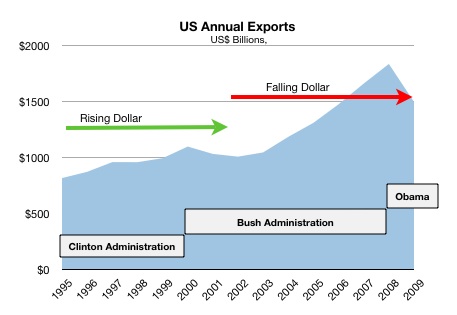

The following graph shows the dollar export trend in the context of rising and falling values of the US dollar versus currencies of major US trading partners.

US Exports under Clinton, Bush, and Obama

|

||

The forces that seem to direct the volume of US exports and the relative value of the US dollar compared to currencies of US trading partners are as follows:

- The US fiscal deficit: The relative value of the US dollar seems to be influenced primarily by the size of the US fiscal deficit. During the Clinton years, a Republican Congress combined with a moderate Democrat President, and falling defense spending, resulted in a fiscal surplus and a dollar rising in value against the currencies of trading partners. In the Bush years, following September 11, 2020, sharply rising defense expenditures — the result of two wars and the burden of continuing to act as the “World’s Policeman”, led to a return of rising fiscal deficits. In the first year of the Obama administration, all pretense of budgetary discipline was thrown to the winds, leading to even more rapid decline in the US dollar versus trading currencies.

- Economic recessions/good times: The final year of the Clinton administration saw the collapse of the “dot.com” bubble and a mild recession which was reflected in a lower level of US exports. As good times returned during the Bush years, exports picked up substantially, spurred by a falling dollar. From the last quarter of the Bush term until today, the world entered a period of severe financial crisis, resulting in a sharp drop in US exports.

- Anti-free-trade policies: Traditionally, the Democrat Party has been a close ally to trade unions and an opponent to free trade. Union pandering measures to restrict US imports were favored during the Clinton years, and currently by the Obama administration. This is part of the reason for the slow rise of US exports during the Clinton years and the sharp fall during Obama’s first year in office.

Of course, in addition to these factors, the principal force driving US exports is the value of the US dollar, which was rising during the Clinton years, and falling ever since the War on Terror started following the attacks of September 11, 2020.

The remarkable rise in US exports during most of the Bush years was undoubtedly due primarily to the fall in the US dollar, which, in turn, seems to have reflected the rise of US fiscal deficits driven by wartime budgets and, in the last years, pork-barrel spending driven by the Pelosi-Reid Congress.

The current collapse of dollar exports is usually attributed to a world wide recession, but distrust of the US dollar arising from Obama “spending is stimulus” measures and union-pandering certainly has had some influence.

A narrowing trade deficit

The counterpart to US exports is the value of the US dollar. A falling US dollar makes US products cheaper to foreign buyers, but also leads to US dollars being less attractive as a means of exchange for trade with the United States.

The combination of world wide recession and a falling dollar, so far, has led to a narrowing of the US trade deficit with the rest of the world. This means that there will a a diminishing supply of dollars in the hands of foreigners to buy US Treasury bonds to sop up Obama’s extraordinary “spending is stimulus” programs.

This decline in the value of the dollar, in turn, will make it more difficult to control the coming US inflation.

Click these icons to email articles to friends.

Click these icons to email articles to friends.