Investor Alert! Sarbanes Oxley Will Likely Be Gutted in 2007

by John Schroy filed under Equities, Foreign Investors, Bankers, Brokers

A self-proclaimed ‘independent, non-partisan’ group of investment bankers, hedge fund operators, leveraged buyout experts, venture capitalists, fund managers, lawyers, accountants, and closely associated academics formed a “Committee on Capital Market Regulation“ that issued a report on US equity markets on November 30, 2020, after less than two months of deliberation.

Barney Frank, D-MA

|

||

The announced purpose of this Committee is to ‘recommend policy changes that should be made, or areas of research that should be pursued, to preserve and enhance the balance between efficient and competitive capital markets and shareholder protection.’

Because this group is extremely well-financed and well-connected, with the ear of the US Securities and Exchange Commission and the Democratic-controlled Congress (through the Brookings Institution, a Committee member, and through Wall Street financial contributions to Representative Barney Frank), its recommendations may effect the future of US capital market regulation for years to come.

There are no representatives of small shareholders on this Committee, and in this regards, the Committee is truly independent from inconvenient opinions of common investors, who blindly trust in Wall Street and the Common Stock Legend, channeling their life savings through retirement funds into equities and 401(k) and IRA plans.

Why Is Sarbanes-Oxley So Hated By Wall Street?

The main recommendation in the first report of the “Committee on Capital Market Regulation” is to weaken provisions of Section 404 of the Sarbanes-Oxley Act of 2002 that call for effective internal controls over accounting practices of public companies.

The Committee reported (in mock horror) that the incremental annual auditing cost incurred under Section 404 for public companies, averages about $4.3 million.

Although this cost is only about 30% of the annual pay of the average CEO of a Fortune 500 company and is falling rapidly as companies establish essential systems of internal controls, the Committee claims this burden to be intolerable, leading to a loss of competitive advantage of Wall Street bankers when soliciting the underwriting of foreign issues into the US market.

However, the Federal Reserve flow of funds accounts show that claims of declining new offerings by foreign issuers in the US market are simply untrue. (See: “Foreign Stock Issues Continue Despite Sarbanes-Oxley“)

Furthermore, sound internal controls are merely a cost of good management and a lack of controls can have disastrous consequences for shareholders, as has been seen with Barings Bank and Enron.

An understanding of the principles of internal controls is not a required discipline to be mastered by graduates of the Harvard Business School. Skills in the more exciting field of “creative finance” are considered more relevant than the dull task of assuring that financial reports are correct or that someone is not stealing a company from under one’s nose.

However, it seems likely that Section 404 is merely a straw man for the real, unspoken objection that Wall Street has to other sections of Sarbanes-Oxley:

Section 401(j) requires that executives certify financial reports as true, and Section 906 provides fines of up to $5 million and up to 20 years in prison for “failure to certify”. (See: “Sarbanes-Oxley and the Shortage of Equities“)

It is much more seemly for executives to righteously point to “excessive costs” and “loss of competitive advantage” supposedly due to Section 404 and “over-regulation” than to admit that they fear stiff penalties for sloppy financial control of public companies imposed by Sarbanes-Oxley.

It is likely that while headlines focus on “reforms” of Section 404 and “improved competitiveness” , the more objectionable aspects of Section 401(j) and Section 906 will be quietly killed in the dead of night by staffers on Barney Frank’s House Financial Services Committee.

Why Barney Frank Will Weaken Sarbanes-Oxley

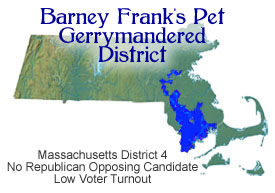

The new Democratic-controlled Congress will have Barney Frank, the representative of the 4th District of Massachusetts, as Chairman of the House Financial Services Committee.

American Democracy in Action

|

||

Representative Frank has already announced before the Greater Boston Chamber of Commerce his intention to weaken Section 404 of the Sarbannes-Oxley Act, citing as justification many of the same reasons (with the same wording and phrases) as in the report of The Committee on Capital Market Regulation.

This is not surprising. The largest contributions, by far, to Barney Frank’s election campaign of 2006 came from Wall Street, led by JP Morgan Chase.

Now, there never was the slightest doubt that Barney Frank would win the 2006 election in the 4th Congressional District of Massachusetts, as he had in every election for over a generation.

First: The 4th Congressional District is Barney Frank’s own personal pet Gerrymander — a true marvel of American Democracy that assures his reelection year after year.

Second: In some years, Barney Frank even runs unopposed. In 2006, there was no Republican candidate and only a weak Independent with no chance of winning.

Therefore, the only reason for Wall Street’s massive campaign contributions to Representative Frank would have been to buy access and a sympathetic hearing for their views, especially with regards to Sarbanes-Oxley and SEC regulation.

The timing of the formation of the Committee on Capital Market Regulation, the ties of its members to Barney Frank, and Representative Frank’s quick parroting of the Committee’s views before the Greater Boston Chamber of Commerce, all lead me to believe that the House Financial Services Committee over the next two years will seek to weaken, rather than strengthen protection for American small investors. (See: “Is the SEC Obsolete: Problems with Non-Merit Regulation“)

Wall Street Will Continue To Lose Competitive Advantage

Of course, with or without Sarbanes-Oxley, Wall Street will continue to lose competitive advantage to foreign capital markets, as has occurred over the last fifty years.

In 1956, when I first went to work on Wall Street, New York City was the undisputed financial center of the world. Europe and Japan were still digging out from the rubble of World War II, London was laboring under socialist government, and the emerging markets of Latin America and Asia were not even imagined by the wildest visionaries.

For the rest of the century, the United States, with Wall Street playing a leading role, worked to fortify the economies of the rest of the world. US investment poured into multi-national corporations that went to build economies, not only in Europe and Japan, but throughout the third world.

US bankers, along with dollar financing, brought techniques of Wall Street to every non-communist country — and after the fall of the Soviet Union, even to the communist world.

From the 1970s onwards, the World Bank, USAID, and the Asian Development Bank, spent hundreds of millions building capital markets in virtually every nation on earth, sending consultants, experts, and advisers from the United States.

Citibank, with the Group of Thirty, led the effort to improve clearings and settlement worldwide.

The SEC, through IOSCO, championed orderly market development along the US model, in hundreds of countries.

By the 1990s, with the fall of the Soviet Union, new stock exchanges came into being in every corner of the globe, from Albania to Zimbabwe, and from Angola to Uzbekistan.

Furthermore, Wall Street firms set up offices in developing markets overseas and vigorously competed for underwritings and the business of local issuers and investors, trading on local stock exchanges, and adopting business plans calling for development of foreign markets, rather than the channeling of business to the United States.

So the lamented loss of “competitive advantage” by Wall Street is pure hooey — a weak excuse by ethically challenged corporate executives to avoid accountability to shareholders.

It has nothing at all to do with Sarbanes-Oxley or over-regulation, but is instead the inevitable consequence of globalization — a large part due to the efforts of Wall Street itself — and the relatively fast growth of the rest of the world, compared to the United States.

A Committee on Capital Market Regulations Could Be Useful If …

Now, there is no doubt that a Committee on Capital Market Regulation that would do all the things this Committee proposes is sorely needed and could be most useful if set up to seek ways to better protect investors and correct distortions in the US capital market. For example, something should be done about the great stock buyback scam, the overpaid corporate executives, and the demise of dividend yields.

But, I’m afraid, judging from this first report, this Committee is likely to champion the status quo and serve interests of its members, rather than suggest reforms that might benefit the great mass of investors or that would ensure a healthy US capital market.