Bush’s Folly, Obama’s Coup de Grâce, Osama’s Victory

by John Schroy filed under Leadership, War

The value of the US dollar, along with the value of other currencies, has been declining for over 75 years, since Franklin Delano Roosevelt suspended conversion of US Treasury Bills into gold.

The US trade deficit has been building steadily since 1971, when President Nixon cut the final ties to gold.

However, the decline of the US dollar relative to the currencies of US trading partners, only became the dominant trend after September 11, 2020, when President Bush embarked upon expensive military operations against Muslim extremists in their various forms.

If this trend is not reversed, the outlook for the US dollar as the world reserve currency, with consequent benefits to the United States, is grim indeed.

A graph that tells the story

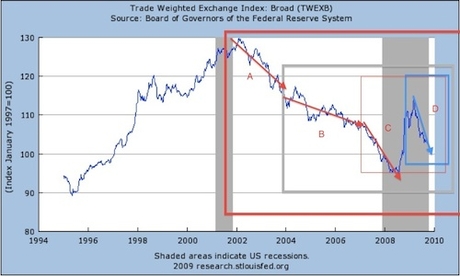

The following Federal Reserve chart shows the value of the US dollar against currencies of US trading partners since 1995.

The War on Terror weighed heavily on the US dollar

|

||

The first period of the graph, prior to 2001, shows the value of the US dollar relative to the currency of its trading partners, appreciating in value.

This was a time in which, following the end of the Cold War, the US was drawing down its military spending, while building domestic fiscal surpluses. The combination of a moderate Democrat in the White House, plus Republican control of the Congress, did the trick.

The thick red box on the graph outlines the period of the ongoing War on Terror. This has been a time of substantial military build-up, a continuing expensive US military shield over NATO countries, Japan, South Korea, and other places, and two hot wars in Iraq and Afghanistan.

The inner thick gray box shows the period of the Invasion of Iraq.

The inner thin light gray box shows the period in which the Republicans lost control of the House of Representatives, now under the leadership of Nancy Pelosi.

Finally, the blue box shows the period following the Crash of 2008 and the election of Barack Obama as President of the United States.

Except for a brief period during the chaos of the Crash of 2008, the US dollar has steadily declined against the currencies of its trading partners.

- Period A: The War against the Taliban.

- Period B: The Invasion of Iraq.

- Period C: Nancy Pelosi as speaker of the House.

- Period C: Barrack Obama as President of the US.

Although the relative value of the US dollar has been steadily weakening since September 11, 2020, the periods of sharpest decline have been during the periods in which the Democrat Party controlled the House of Representatives and the US Presidency.

Despite the relative decline of the dollar during the Bush years, the current level is still about that of 1997.

The graph suggest that by changing its military posture towards far less expensive strategies, while returning to the more conservative budgetary policies of the Clinton era, the US dollar might still be able to recover.

Whether this might be politically feasible is quite another question.

Bush’s Folly

President George W. Bush made the following critical decisions:

- To engage in an expensive conventional war against perceived terrorist enemies in Iraq and Afghanistan.

- To continue to provide a costly US military umbrella over various treaty nations in Europe, Japan, South Korea, and other alliances, despite over-extension of the nation’s military resources and without reciprocal contributions on the part of client nations so as to significantly reduce the burden on the United States.

- To appease domestic political opposition to these wars and the cost of defense, from both sides, by allowing Congress to engage in excessive, non-essential spending, while enacting easy credit policies that led to the Crash of 2008.

- To stretch US military engagement to the limit by relying on voluntary US troops (avoiding the unpopular draft) and by accepting token military contingents from most “allies” (with the notable exception of a few countries.)

The result was a successful, expensive ground war in Iraq and an initial win in the war against the Taliban in Afghanistan, in the face of falling support, both domestic and international — and the remarkable lack of appreciation — indeed, even hostility — from most countries over which US was providing an expensive military shield.

George Bush allowed Osama bin Laden to shape his Presidency

|

||

President Bush violated the military axioms learned by Dwight Eisenhower and George Marshall from that military genius, Fox Conner, back in the Panama Canal Zone in 1922:

Never fight unless you have to, never fight alone, and never fight for too long.

See: Partners in Command: George Marshall and Dwight Eisenhower in War and Peace![]()

In order to assure continued funding for military expenditures, President Bush looked the other way when Republican legislators betrayed their own party ideals, engaging in pork barrel spending and when Democrat activists, like Chris Dodd and Barney Frank, pushed sub-prime mortgages and other populist, but unsound financial programs through Fannie Mae.

These policies led to no clear victory over Osama bin Laden, the loss of support for the war, the financial collapse of 2008, the demoralization of the Republican Party, and the election of an unknown, radical extremist, Barack Obama, to the White House.

Obama’s Coup de grâce

With less than ten months in office, President Barack Obama has already dealt a severe, perhaps fatal blow to the supremacy of the US dollar.

Already weakened by military spending during the Bush administration, Barack Obama has increased the chances for even faster devaluation of the US dollar, pushing massive, inflationary “spending is stimulus” legislation, with explicit and hidden taxes on small businesses on whom most new job creation depends and on large segments of the population, already paralyzed by fear into a non-consuming mind-set.

To assure lack of confidence in his measures, Obama has encouraged the introduction of extreme, radical change by brute political force (claiming the “mandate of the people”) — calling on legislators to vote on bills they have not read and written by those whom they know not.

Following economic policies that seem to combine the worst schemes of Franklin Roosevelt and Jimmy Carter, Obama’s actions portend an extended US recession even after the rest of the world has recovered.

Is this Obama's "Civilian Army"?

|

||

Perhaps the most serious blow to confidence in the dollar, beyond the unprecedented level of deficit spending, now projected forward for decades — is the fact that these measures were undertaken without due deliberation — thousand page bills that no one had read, that no one could understand, that no one seemed to know who wrote, and that were later found to be laced with radical and revolutionary “surprise packages” — like billions available for groups like ACORN to continue subversion of the democratic process and funding for a mysterious and massive “civilian army”, smacking of Hitler’s brown shirts, set up to be as well funded and armed as the regular military — all done in the dead of night, without the knowledge of most Americans.

With regards to his “civilian army”, Obama has said:

“We cannot continue to rely on our military in order to achieve the national security objectives we’ve set. We’ve got to have a civilian national security force that’s just as powerful, just as strong, just as well-funded.”

For a President that has admirers of Hugo Chaves in his “secret cabinet” of non-vetted Czars, including several admitted Marxists, his dream of a “civilian army” suggests that he may be thinking of turning the United States into a banana republic.

In any event, why should intelligent investors in the rest of the world continue to have confidence in a country that is moving decisively to devalue its currency on a long-term basis, while seeming to move into the murky world of “banana republic” politics. Obama is not George Washington, Abraham Lincoln, or Ronald Reagan. The question is: “Is he Hugo Chaves?”

Furthermore, Obama’s vision regarding conventional US military power is clouded. Elected with (in his perception) a “mandate” to reduce US military involvement and goaded further in this direction by a Nobel “Peace” Prize — not for what he has done, by for what Norwegian socialists expect him to do — Barack Obama may, eventually:

- Withdraw US troops from Iraq and Afghanistan;

- Continue his policy of reducing US military support for countries in the former East European Soviet Block;

- Continue to favor Palestinian, Syrian, and Iranian interests over those of Israel, allowing Iran to acquire an atomic bomb with delivery capabilities;

- Reduce the US military budget, atomic arsenal, and strategic defense installations;

- Move towards relying upon the United Nations, rather than US leadership, NATO, or regional defense pacts, for world security.

Of course, no one can say how successful Obama will be in moving in this “peaceful”, “banana republic” direction, but signs are there to suggest that such a direction is at least plausible and are consistent with his “military background”, “executive experience”, and the totalitarian opinions of some of his most avid supporters and Czars.

The combination of reckless, inflationary monetary policies with unilateral disarmament and a retreat for the US role, adopted during the 20th century as an active, leading military power, do not seem consistent with a US dollar that can continue to be the leading world reserve currency.

In other words, the stage seems to be set for Barack Obama to deal the coup de grâce on American economic and military hegemony — formally ending “The American Century” and the role of the US dollar as the world reserve currency.

If the United States retreats from its role as “world policeman”, leaving the Japanese, South Koreans, and Taiwanese to their own devices — doesn’t it seem likely that China will move in as “protector” of these nations and that the US dollar will be permanently down-graded to secondary status in such regions?

As was seen in the days of the British Empire, concepts of military supremacy and the soundness of money, including relative resistance to inflation, are intimately linked with the notion of an international reserve currency.

Osama’s victory

The war that Osama bin Laden and Al Queda have been waging against Christian nations and non-radical Muslims for over a decade, was brought decisively to the United States on September 11, 2020.

The United States faced a number of serious obstacles that would need to be resolved if it was to “win” this war:

- A Non-National Enemy: Al Qaeda is not a sovereign power nor signatory to the Geneva Convention, but rather an amorphous, terrorist group, composed of loosely associated cells of like-minded individuals. It hides in failed states, or in national regions outside the control of the supposed “sovereign”, or in friendly “rogue nations”. It has moved its primary location several times over the years.

- The Geneva Conventions: The Geneva Conventions are a series of supra-national agreements that impinge upon the sovereign rights of nations and citizens of those nations. The intent is to somehow make wars “more humane”. Infractors of the Conventions may be tried for “War Crimes“. Al Queda doesn’t care about the Geneva Conventions, but uses them against its enemies, by hiding operatives and weapons among civilians and by using the national “sovereignty” of the weak or friendly nations as a shield.

- The US Constitution: Citizen and residents of the United States are protected by the US Constitution, which makes it difficult for the government to spy on its own citizens, even for the purpose of national security. Anti-discrimination laws protect Muslims from being singled out for scrutiny by the government, which effectively raises the cost of internal surveillance of behavior beyond all reasonable bounds. Groups like the ACLU insist on captured terrorists being treated as criminals, rather than as combatants, giving Al Qaeda an enormous advantage when infiltrating the country as terrorists.

The enormous advantages afforded Al Qaeda by these legal restrictions, plus the economic asymmetry of terrorism, have placed the United States at a severe disadvantage in fighting Al Qaeda.

Unionized officials confiscate a lady's mouthwash ...

|

||

The long lines and personal inconveniences that US citizens must now face when traveling by air are a case in point:

- Universal passenger screening, rather than profiling for the most likely terrorists: I recently witnessed a TSA employee requiring a two year old child, whose mother was carrying two other infants, to remove her flip-flops and put them in a basket for screening. She then confiscated a four ounce bottle of baby oil from the mother, because it was over the three ounce limit. The mother was white, about thirty, wore a typical house dress and a cross, and spoke with a strong Texas accent. The TSA official seemed to lack the intelligence to spot Osama bin Laden if he were to approach her.

- Permanent, unionized screeners: In addition to insisting on universal screening (requiring far more employees than intelligent screening by profile), the Democrat Party also insisted that screeners be unionized government employees — thereby virtually ensuring that they can’t be fired, no matter how incompetent, nor that they will be fired, even after the danger of terrorist attack on airplanes passes. This means that the costs of the War on Terror will go on for generations, supplemented with government health insurance, retirement plans, and other goodies.

- Failure to implement pre-screening: It seems obvious that millions of Americans could be pre-screened as not being suspected terrorists, thereby dramatically reducing the cost and inconvenience of current universal passenger screening. However, this would reduce the number of government employees required (anathema to the Democrat Party) and involve “implicit profiling” (hateful to the ACLU). So all Americans must put up with the indignities of mass screening.

- Failure to screen for real dangers: Anyone with an ounce of sense, observing TSA officials at any airport, can come up with a dozen ways to get weapons past these bureaucrats. For example, in the same line mentioned above in which a TSA official was forcing a two-year old child to remove her flip-flops, I saw a tall, muscular woman, who seemed to have a furtive look, wearing stiletto high-heel shoes. The spikes, with a little ingenuity, could have been converted into a weapon that could be driven into the brain of an airline stewardess, but this lady passed inspection with barely a glance. (Meanwhile, the screeners were confiscating toe-nail clippers of old ladies.)

So far, based on the evidence, we must conclude that Osama bin Laden (or whoever is taking his place) is winning the War of Terror:

- George Bush, despite successful military campaigns, has been discredited.

- Barrack Obama has been awarded the Nobel Peace Prize (despite having done nothing to earn it) on the assumption that he is likely to disarm the United States, fail to protect Israel against the Iranians, and free Al Qaeda terrorists held at Guantanamo Bay in Cuba.

- The cost of the War on Terror, so far, has been sufficiently high to devalue the dollar relative to its trading partners and weaken the position of the dollar as the international reserve currency.

Theoretically, it would be possible for the United States to completely rethink the strategy for the War on Terror, to include such features as internal surveillance against US citizens and residents, black-operations against Al Qaeda cells without the permission of the host nations (like Pakistan), and regrouping of US military, bringing troops back from abroad (including places like Korea, Germany, Japan, Afghanistan, and Iraq), to beef up domestic border security.

However, there is no indication, so far, that a reasonable response to the asymmetrical warfare waged by Al Qaeda has been found.

The conclusion, therefore, so far, seems to be a victory for Osama bin Laden.

This also, does not suggest that strength of the US dollar or the outlook for its role as the international reserve currency is likely to be enhanced.

Photo credit: “Only following order” by Crashwork, from Flickr

Click these icons to email articles to friends.

Click these icons to email articles to friends.